As promised, we will do a short series on the current market situation for the Georgia cotton farmer. The first and biggest factor in the current market is China.

In early 2011 the Chinese government announce it would start buying cotton for its “state reserve” program. Some say that China did this because they feared they would run out of cotton for their domestic cotton mills to spin into yarn. This may be true but I think the situation is a little more complex than a supply and demand issue at the mill level. It seems to be more of a political issue. China has seen tremendous growth in it’s economy in the last 20 years. Much like the US in the post WWII phase, many new industrial sectors have grown in China since the early 1990s. Most of these factory jobs require cheap labor, labor that sometimes attracts farmers from rural China to move to the city for work (similar to US in 1950s and 1960s). This, I think, put some political pressure on the Chinese government to do something for their farmers who were getting older and couldn’t find the young labor to help or take over their farms because they had sought a more prosperous job in the city. Couple this with what they thought was a low 70-80 cent price, and a buying and storing program may not seem like a bad idea. The program should bump price up enough to make rural Chinese cotton farmers economically viable and attract more younger folks to stay on the farm as well as create a steady supply of cotton to the local Chinese cotton spinning mills. Seems like a good solution to a complex problem. This isn’t unlike many other programs of the past; for example the US grain buying/storage policy of the 1970s and the very recent Thailand rice buying/storage program which ended in early 2014.

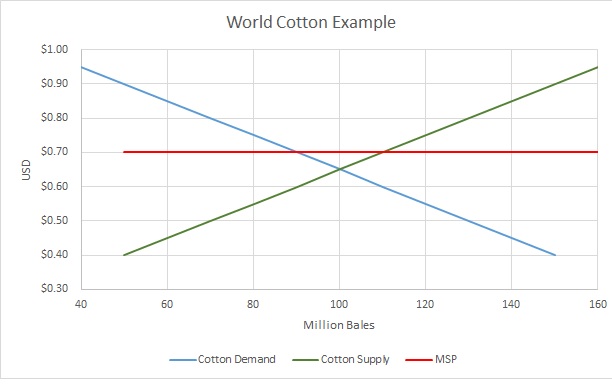

The problem with any buying and storing program is that it artificially effects supply, either by storing and reducing supply or by selling it and expanding supply. This makes any commodity market more volatile and makes it almost impossible to predict a local price for the foreseeable future. That is exactly what happened when China started buying and storing cotton in 2011, the market went to record highs and it came crashing down to near record lows when they stopped buying and started selling in the spring of 2014.

This rapid run-up in prices and the huge volatility that has been introduced along with it was actually good for the Georgia cotton farmer in the short-run. The 2011-13 crop years saw great cotton prices mainly because we had a great export market wide open in China since their mills were having a hard time buying cotton (the govt. program guaranteed about $1.47/lb, so almost all of the local cotton was bought by the govt. and not mills). Because the cotton mills were paying higher than average prices and could not guarantee a future supply, many started spinning less cotton and more MMF (man-made fiber). This was purely an economic decision for the mills since they could get MMF for about half of the cost of cotton. I do not believe, as some suggest, that mills are using more cotton because of more people demanding cloths from MMF. I think the clothing demand stemmed from the high cost of cotton and the move by mills and clothing manufacturers to blend more MMF into their cotton products. I think this is called supply-side economics. The technology in MMF is hard to compete with and many consumers don’t even know that their favorite dress shirt or favorite blue jeans are not 100% cotton. Now that these products are a mainstay, it will be extremely difficult for cotton to make a huge comeback unless the price was very low.

Well, now that the Chinese government isn’t buying cotton, and the Chinese mills have an ample supply of cotton, cotton prices are very low. Low enough to compete with MMF. So from the mill and textile side of the business, there are some incentives to spin more cotton. Only time will tell if this actually happens.

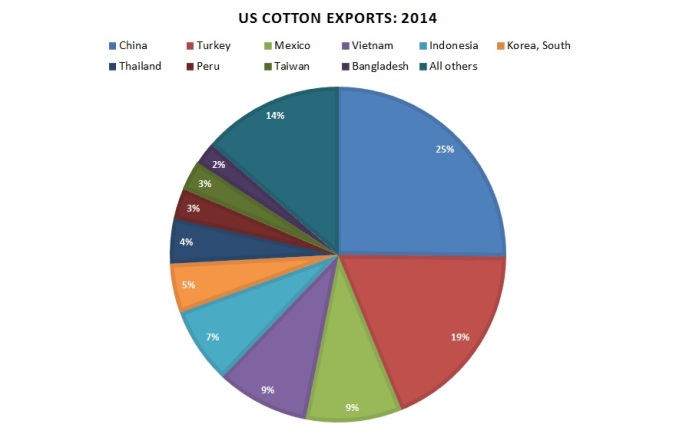

In the meantime, because of the glut of cotton in storage it doesn’t appear that we will see high prices this crop year. There is just too much cotton sitting in warehouses (mainly in China, about 60 million bales, but another 30 million bales in the rest of the world). The one bright spot is that high quality cotton is in good demand. It appears that most of the cotton being “auctioned” by the Chinese government to the Chinese mills is of lower quality. Partly this is due to the fact that some of the cotton they have in storage is from the 2010 crop and partly because most of their cotton reserves are hand-picked Chinese grown cotton, which typically isn’t as high of quality as US machine-harvested cotton. This weird situation of having too much cotton in the world but exporting record amounts of bales should pull price up. But the fact that there are still around 60 million bales in Chinese storage doesn’t really put much pressure on the market for it to go way up anytime soon.

Looking forward China should actually reduce it’s cotton acreage in the short-term and probably increase its acres over time. I failed to mention earlier that the new Chinese policy is no longer buying and storing cotton at $1.47, but it will pay a producer the difference between $1.40 and the current market price for growers in the western region of China. Growers in select eastern regions get a direct 14 cent/lb payment. Most of the cotton in China is grown in the eastern region on small plots by hand. Western China has some mechanization and has the potential to expand machine-harvested cotton acreage. Data is sparse and probably very rough, but I’ve heard Chinese cotton production is about 60% in the eastern region and about 40% in the western region. The eastern regions of the country are home to the majority of the population. As mentioned earlier, China has been growing rapidly in the last 20+ years. Now they actually have a middle class that demands more than just rice and fish for meals. The new government policies are encouraging growers in the eastern region to grow more grain, mainly to feed their growing livestock industry but also to feed their growing middle class. The high target price program instituted only in the western region is a good indication that the government of China would like to see more cotton grown in the west and less in the east. This transition will temporarily reduce acreage, but if they policy is still in place in 3-5 years I could see China outpacing India and becoming the worlds largest cotton producer again.

Therefore, it is imperative that a Georgia cotton grower understands the situation in China and understand how this is affecting the market. The National Cotton Council has been meeting with the US Trade Representative’s office for years now trying to explain this so that the USTR can bring this up to the World Trade Organization (WTO). China’s policy has not only affected the Georgia cotton farmer, but cotton farmers all over the world minus China. We were very happy the Sen. Johnny Isakson brought up this important issue at a recent Senate Trade Committee hearing.